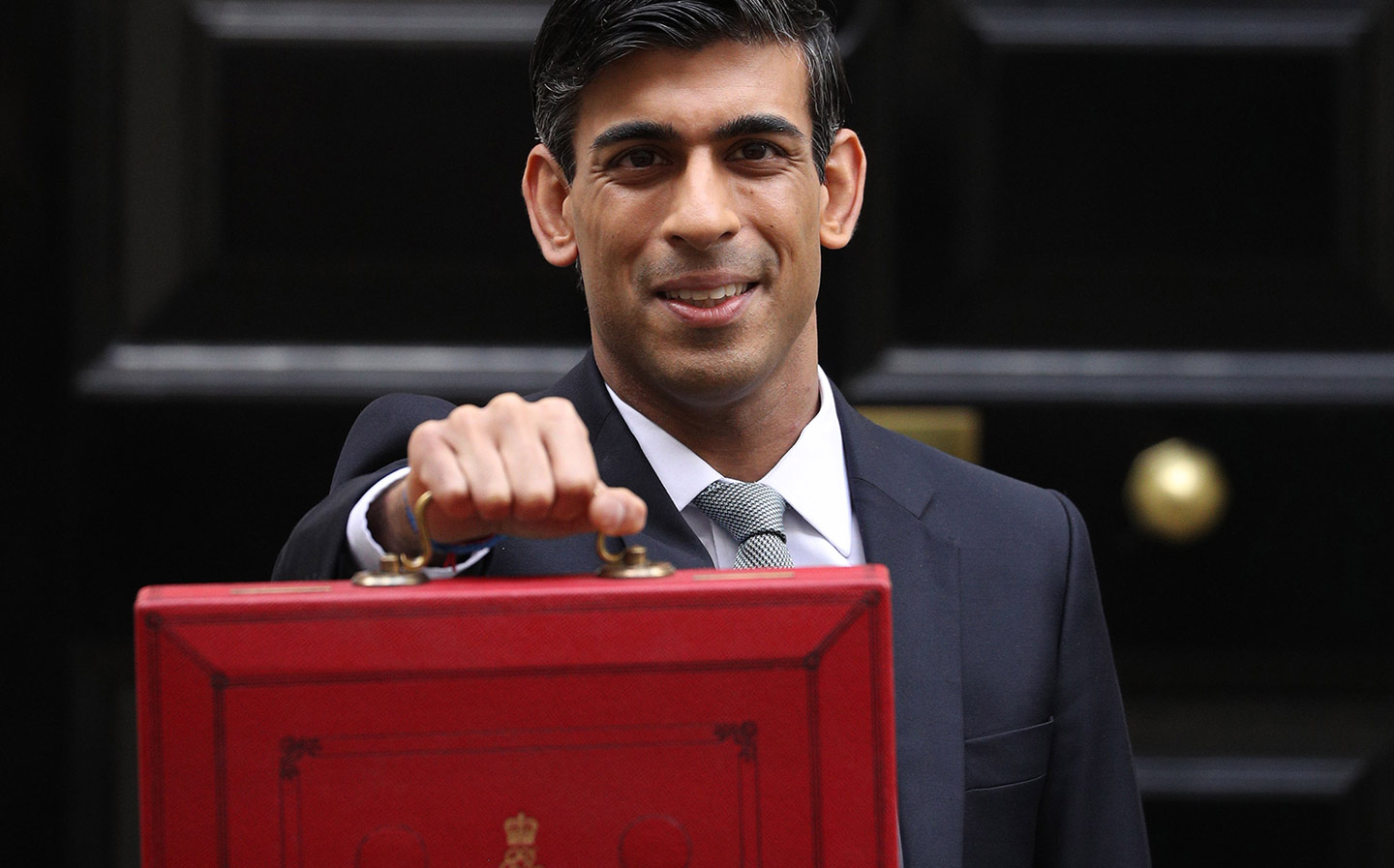

After what was probably the most anticipated budget in living memory, it was nothing more than a ‘damp squib’ when it came to Capital Gains Tax (“CGT”). Predictions of CGT rises were rife, particularly in the latter stages of 2020 as the cost of the pandemic became clearer. However, with several “leaks” as budget day came closer, it looked as though it would be corporation tax would be increased rather than CGT, and ultimately the leaks were correct, with no changes to the rate of CGT.

Attention now turns to the 2022 Spring Statement and we expect that with a recovery hopefully on the cards, the Chancellor’s generosity will be running thin; he has repeatedly alluded to “fixing the public finances” when the recovery is underway. The current political environment does not lend itself to big cuts in spending which means inevitable tax rises. Our view for a while now has been that CGT will rise and there is always the risk an announcement will come in the Spring of 2022, albeit we do not think rates will rise to the point where they are in line with income tax rates. With a review into CGT ongoing, it seems like an easy target for the Chancellor.

So, what does this mean for entrepreneurs looking to exit in the coming months/years? Well if you are in a position to consider an exit/partial exit, we would recommend speaking to an advisor to consider your options, as even a small change in rates can lead to a significant increase in your tax bill upon exit. Whether you are looking to retire and realise the full value of the business or de-risk by taking some cash off the table, we can help you to assess your options and decide on the best route forwards, whilst CGT rates remain low.

Please do get in touch with James McBain Allan or any of the Deal Makers to discuss your options.